Financing Fees Debt Issuance Costs in M&A

For example, if a company spends $10,000 to acquire a loan, this amount will get recognized as an asset. The FASB

again indicates that the effective interest rate method should be used. First, the financial institute https://accounting-services.net/bookkeeping-kent/ standard board recommends using the effective interest rate which depends on the cash flow. Loan only recognized base on the cash flow into the company, so it will net off with the deferred financing cost.

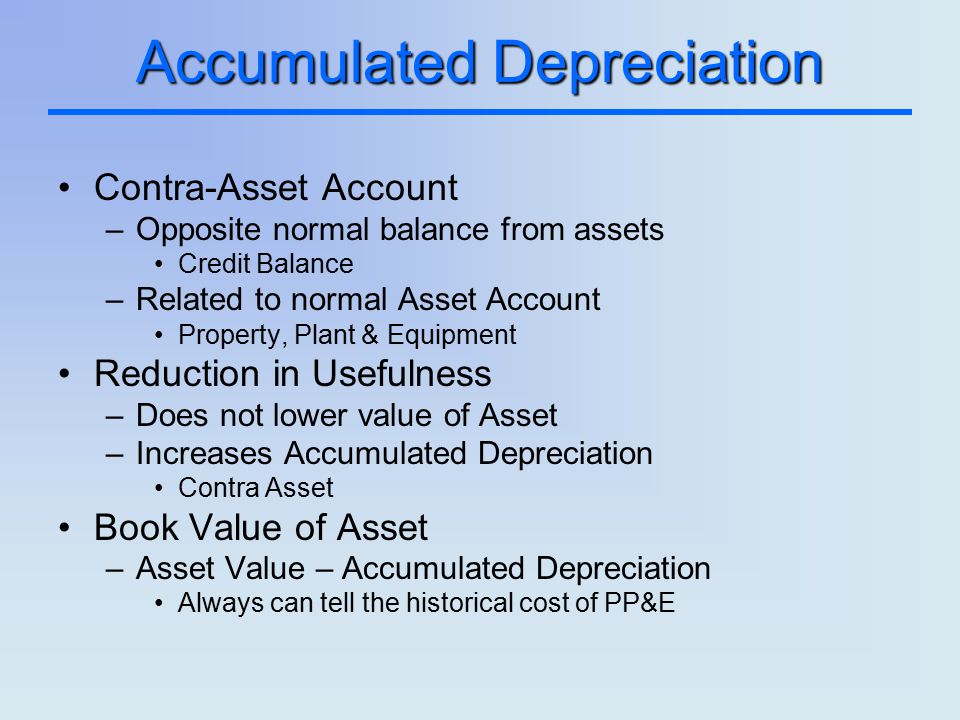

The Board received feedback that having different balance sheet presentation requirements for debt issuance costs and debt discount and premium creates unnecessary complexity. The matching concept in accounting requires companies to match expenses to the revenues to which they relate. Therefore, companies may spread costs over several years to ensure that. A typical example of the matching principle affecting accounting is depreciation. Companies spread the cost of their assets over several years to reflect the revenues they help generate. Base on the above example, the loan fee $ 200,000 needs to allocate over years which is the loan term.

Site and content preferences

The effective interest rate method, as we will see further,

results in a constant rate of amortization charges in relation to the related

debt balance. The straight-line method, however, results in a lower rate during

the first part of a debt term and higher rate towards the end of the debt term. The effective rate will be calculated using the XIRR formula which usually found in Ms. Excel. It is the formula used to calculate the internal rate of return (IRR) for a series of cash flows which not periodic. The rate will depend on the amount for cash flow and each specific date.

Large and growing small businesses would incur expenses for issuing debt instruments, such as bonds, to investors. These expenses include legal fees, registration costs and commissions. Debt-issuance costs go on the cash flow statement through the income statement as expenses and also through the balance sheet as changes to cash assets. The proceeds from the debt issues go on the financing-activities Accounting for deferred financing costs section of the cash flow statement, but the issuance costs go on the operating-activities section. My interpretation is that in this case you should just record the full amount of the deferred financing costs as a contra-liability, but there is a gray area and people can come up to different conclusions. There is a little controversy related to accounting for

deferred financing costs.

Everything You Need To Master Financial Modeling

In the first stage, Red Co. recognizes the whole amount as a deferred financing cost using the following journal entry. Whether a bond issuer decides to use private placement or underwriter placement, the company will incur certain costs such as legal costs, printing costs, and registration fees. The US Generally Accepted Accounting Principles provides guidelines on how companies should account for such costs.